maine sales tax calculator

The average cumulative sales tax rate in Dixfield Maine is 55. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

How To Charge Your Customers The Correct Sales Tax Rates

Sales and Gross Receipts Taxes in Maine amounts to 24 billion.

. That said some items like prepared food are taxed differently. Rate Type Effective 102013 Effective 012016 Effective 012017 Effective 02012018. The tax that is levied on lodging and prepared food is 8 and furthermore the short-term auto rental is 10.

Avalara provides supported pre-built integration. The sales tax rate does not vary based on zip code. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Auburn is located within Androscoggin County Maine. Portland is located within Cumberland County MaineWithin Portland there are around 9 zip codes with the most populous zip code being 04103The sales tax rate does not vary based on zip code. The Maine ME state sales tax rate is currently 55.

Sales Tax Rate s c l sr. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or salestaxmainegov.

The car sales tax in Maine is 550 of the purchase price of the vehicle. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Food and prescription drugs are exempt in Maine while prepared food lodging and auto rentals.

Office of Tax Policy. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Maine Sales Tax Exempt Organizations.

Groceries and prescription drugs are exempt from the Maine sales tax. The rates drop back on January 1st of each year. Thats why we came up with this handy Maine sales tax calculator.

This includes the rates on the state county city and special levels. This includes the rates on the state county city and special levels. This state sales tax also applies if you purchase the vehicle out of state.

The goods news is that Maine sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies. Well speaking of Maine there is a general sales tax of 55. Integrate Vertex seamlessly to the systems you already use.

Numbers represent only state taxes not federal taxes. Counties and cities are not allowed to collect local sales taxes. This includes the sales tax rates on the state county city and special levels.

Maine sales tax details. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. 2022 Maine state sales tax.

If youve opened this page and reading this chances are you are living in Maine and you intend to know the sales tax rate right. Maximum Possible Sales Tax. Maine levies taxes on tangible personal property which includes physical and digital products as well as some services.

Sales and Use Tax Rates. Within Auburn there are around 3 zip codes with the most populous zip code being 04210. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

Sales Tax calculator Maine. Exact tax amount may vary for different items. Sales and Use Tax Rates Due Dates Rates.

For example the owner of a three year old motor vehicle with an MSRP of 19500 would pay 26325. Retailers can then file an amended return at a later date to reconcile the correct tax owed. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

The average cumulative sales tax rate in Portland Maine is 55. Dixfield is located within Oxford County MaineWithin Dixfield there is 1 zip code with the most populous zip code being 04224The sales tax rate does not vary based on zip code. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate.

Maine does not apply County Local or Special Sales Tax Rates tso the Total Sales Tax applied across the State of Maine is 55 you can calculate Sales Tax online using the. So whether you live in Maine or outside Maine but have nexus and sell to a customer there you would charge your customer the 55 sales tax rate on most transactions. Average Local State Sales Tax.

Your household income location filing status and number of personal exemptions. Maine Sales Tax Rates. The average cumulative sales tax rate in Bowdoin Maine is 55.

This includes the rates on the state county city and special levels. Within Bowdoin there is 1 zip code with the most populous zip code being 04287. The average cumulative sales tax rate in Auburn Maine is 55.

The average cumulative sales tax rate in Brunswick Maine is 55. For example if you purchase a new vehicle in Maine for 40000 then you will. Bowdoin is located within Sagadahoc County Maine.

Sales tax is not collected at the local city county or ZIP in Maine making it one of the easier states in which to manage sales tax collection filing and remittance. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied. Find your Maine combined state and local tax rate.

The maine state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 maine state tax calculatorwe also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for. Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov. The sales tax rate does not vary based on zip code.

Affidavits Applications. This includes the rates on the state county city and special levels. It is 4951 of the total taxes 49 billion raised in Maine.

Brunswick is located within Cumberland County MaineWithin Brunswick there is 1 zip code with the most populous zip code being 04011The sales tax rate does not vary based on zip code. The state sales tax rate is 55 and Maine doesnt have local sales tax rates.

Maine Vehicle Sales Tax Fees Calculator

Maine Vehicle Sales Tax Fees Calculator

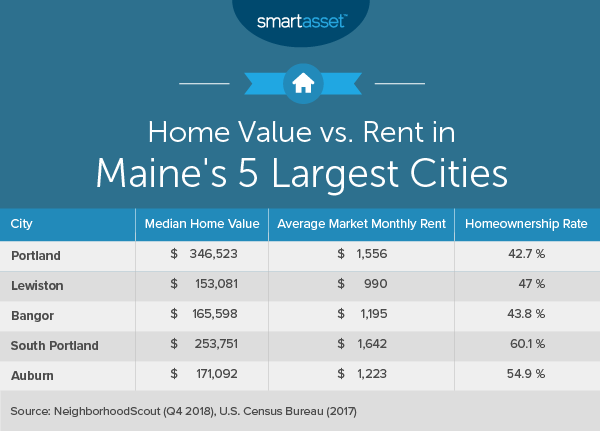

What Is The Cost Of Living In Maine Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Cannabis Taxes At Your Dispensary

Maine Sales Tax Information Sales Tax Rates And Deadlines

Maine Sales Tax Rates By City County 2022

Maine Vehicle Sales Tax Fees Calculator

Maine Vehicle Sales Tax Fees Calculator

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Maine Sales Tax Guide And Calculator 2022 Taxjar

Maine Sales Tax Small Business Guide Truic